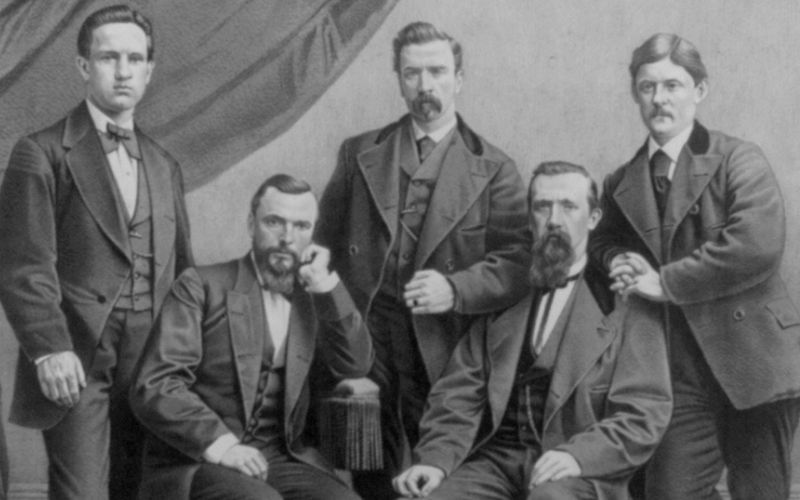

| Brian Goggin, formerly of the Bank of Ireland |

I'm not just talking about the property speculators and developers playing with their borrowed billions who were in an inner platinum circle all of their own. The golden circle was far wider than that.

It included bankers, lawyers, accountants, financial advisers, brokers, management consultants, IT experts, the top layer of professionals of all kinds -- and it also included the senior levels in the civil service and state agencies, the guys and gals who actually run the country for the politicians.

So having comprehensively screwed up the country and plunged us into a financial catastrophe so bad that we had to be rescued by the IMF and the EU, all these guys and gals are now out of a job, right?

Not at all. This is Ireland, after all. The unbelievable, extraordinary truth is that almost all these experts and advisers have held on to their top jobs and are still doing very well, thank you very much.

While the ordinary folk here struggle in the darkness of lay-offs, welfare cutbacks and tax hikes, the sun is still shining brightly on our golden circle.

Of course there has been some token changes. At the very top of the Department of Finance, the Central Bank, the Financial Regulator's office and, of course the banks, a few people were shifted. A couple went to cozy positions in Europe with big salaries attached, and the others were put out to grass with pension pots worth millions and huge golden handshakes so they can continue to enjoy the privileged lifestyles they expect.

Only a very small number of people were moved from the leadership roles they had. In fact you could count on two hands the number of top dogs who were moved.

The majority of the top layer of people, who all played a part directly or indirectly in destroying our economy, are still there. The senior civil servants, the financial experts, the consultants, the lawyers, the accountants and auditors are all there and still being paid boom time salaries and fees.

The game has changed, of course. Instead of advising the government and businesses on the boom, they are now advising them on the bust.

The bankers and accountants and auditors and consultants who failed to see the developing bubble are now the ones making fortunes dealing with all the businesses that are going bust. Dozens of them have even been hired to play key roles in NAMA, the national bad bank where all the toxic property loans have been dumped.

So the very people who made the mess are now the ones making a very lucrative living out of trying to sort it out. Two or three of the biggest legal firms and accountancy firms here which were up to their necks in the boom are now "advising" on the bust.

This is enough to give you indigestion. But what is really sickening is that the members of this very large golden circle are still charging eye-watering fees for their services.

We're talking hundreds of euros an hour here. And

they are getting away with this even though the country is broke -- and it's broke thanks to their incompetence.

It starts right at the top, of course, with our politicians, who are paid far more than their European counterparts. We all know the taoiseach (our prime minister) earns more than the U.S. President. But he also is paid more than the British prime minister and more than the heads of most European countries, which may be a less dramatic comparison but is more relevant.

The same applies to the civil servants who head up government departments here, and to many other areas of Irish government and professional life. Consultant doctors and top lawyers in Ireland earn far more than their counterparts in Europe.

Further down the ladder, senior teachers here earn at least 20 percent more than teachers in Britain, for example. And it goes on and on, increasingly dividing Irish society into those who are comfortable and those who are struggling to make ends meet.

The common factor among those who are doing okay -- in case you haven't spotted it already -- is that they all work for the state or for semi-state organizations (except for the bank bosses, although you could say they also work for the state since the state now owns the banks).

This influences fees that are charged by others who provide professional services to the state (like lawyers and accountants) and so they keep their fees and charges high. Why should they bring them down when they see all the others in the golden circle hanging on to their high pay and status?

What all this means is that we are developing two Irelands. There are those who are paid by the state, directly or indirectly, and who see no reason to moderate their pay or pensions as long as the state can borrow enough to keep going; since it's all paid for by borrowing, there's no real limit.

Then there is everyone in the private sector, where pay and pensions depend directly on the ability of a company to make a profit and stay in business --and for more and more of them, the cost of keeping a job or continuing to get a pension means taking huge cuts in what they are getting.

The pension divide between the two Irelands is even more nauseating than the pay situation. Let's start with two of the most infuriating examples from the top of the golden circle.

You may remember the name Brian Goggin, the boss of Bank of Ireland during the boom. You also may remember the name Eugene Sheehy, who was the boss of AIB during the boom and property bubble, which of course only happened because the two banks (the biggest in Ireland) made it possible through reckless lending.

Sheehy has a bit of extra notoriety because he was one of the senior bankers who had the late night meeting with the taoiseach and the minister for finance in September 2008 and pleaded for help to help them get through their "temporary liquidity problem."

The result was the government guaranteed all bank debt, a decision that has bankrupted the country because the real level of the bank debts was many times greater than Sheehy and his buddies revealed to the government that night.

The banks did not just have a liquidity problem. They were insolvent. They were completely bust, owing tens of billions of euro with not a hope of ever being able to pay it back.

So Goggin and Sheehy were major players in destroying the Irish economy and losing us our economic sovereignty. Not only that, but we taxpayers have had to meet the cost of pouring billions into AIB and Bank of Ireland to keep them open.

Did the two boyos go to jail? Or even have to do some community service to atone for what they had done? Not at all. This is Ireland, after all.

They were both moved, given early retirement. And this is the best bit. Goggin is on a pension of €650,000 a year for the rest of his life. Sheehy's pension is €450,000 a year for life.

Both are still relatively young. Sheehy has gone

back to college. Goggin is back at work, playing a leading role in a multi-billion U.S. investment group that is targeting distressed property loans in Ireland and buying baskets of insurance policies from finance institutions here that are under pressure.

These are extreme examples of the way golden circle members here get looked after. But the same stuff goes on all the way down the state food chain, with state employees getting very generous guaranteed pensions for life, typically between half and two thirds their final salary.

And it's all funded by state borrowing, so there is no limit on what it costs. Contrast this with the private sector, where almost 80 percent of company pension funds are bust, thanks to the financial collapse.

Let's take an example to illustrate what's going on. The pension fund in Independent Newspapers, the biggest newspaper group in Ireland where this writer has worked, now has a black hole in it of some €160 million and is probably going to be closed down, leaving a lot of people with little or nothing.

Meanwhile out at Dublin Airport, the umbrella pension fund that looks after staff in Aer Lingus, the DAA company that runs Irish airports and a linked aircraft maintenance company, has a black hole in it of €750 million. Because Aer Lingus and the DAA are semi-state companies, the unions are trying to force the government to pump money into this pension fund so staff can get their full pensions.

And you are all going to know about this very soon because the unions are threatening a wave of strikes in the run up to Christmas that could disrupt trans-Atlantic flights.

The fact that the pension fund is bust -- there's no way back from a €750 million deficit -- and the state is bust, makes no impression on these semi-state workers. As far as they are concerned the state must borrow to back fill their pension fund. It's that simple.

In the real world of the private sector, such nonsense is not an option for workers because their companies cannot borrow like this and could go under if they tried. Independent Newspapers is already struggling for survival, quite apart from its pensions problem.

It's a two Ireland scenario. Unfortunately the politicians and the civil servants who run the country are all part of the Ireland that is okay.

They talk a lot, but there is no action to reduce the problem for the private sector workers who are part of the other Ireland. Instead we get lectures from union leaders about avoiding a race to the bottom in wages and pensions.

Like I said, the golden circle is still shining, but the glow is making the rest of us feel like throwing up.

Comments