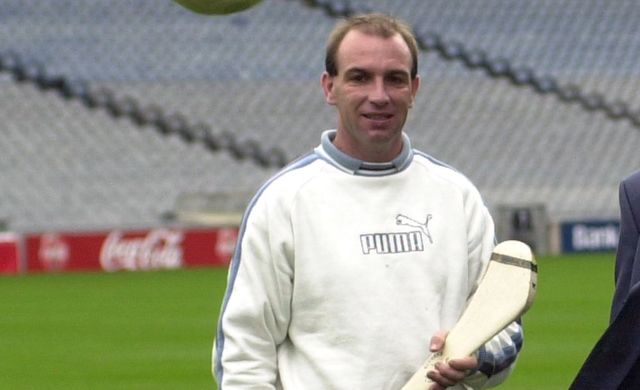

Irish hurling legend DJ Carey secured a settlement with AIB that saw a debt of over €9.5 million written down to just €60,000, according to a shocking new report.

The settlement, reached in 2017, meant that Carey paid just 0.63% of the €9,528,411 he owed to the majority state-owned bank, according to RTÉ Prime Time.

In May 2011, AIB secured a High Court judgment requiring Carey to pay the €9.5 million, mostly arising from a €7.85 million loan to Carey that was secured against his properties at Mount Juliet in Kilkenny and the K Club in Kildare.

However, in the settlement, the bank described the 99.37% write-down of Carey's debt as a "compromise".

A windfall clause included in the settlement required Carey to pay any cash that caused a €50,000 increase in his net worth to AIB. The windfall clause included any relevant "gift, award, inheritance, prize, lottery prize or gambling winnings" but expired in April 2022.

In April 2018, AIB wrote to Carey to acknowledge that it received the €60,000 settlement funds and that they had been "accepted in full and final settlement of your liabilities with the bank in accordance with the terms of the settlement agreement".

Carey previously pledged to pay back as much of the borrowed money as possible.

"You borrow money, it should be paid back," Carey told RTÉ radio's Ray D'Arcy Show in 2015. "To whatever extent that can be, I would still be conscious it has to be done."

Fine Gael TD Neal Richmond, a Minister of State at the Department of Enterprise, has said that AIB should appear before the Oireachtas Finance Committee to answer questions about the settlement with Carey.

"Anyone reading that story overnight, it is extremely worrying, and personally I’d like to see AIB come before the Finance Committee to lay out exactly the nature of this and indeed address the question ‘were there other write-downs?’ and to explain and to have a debate," Richmond told RTÉ's Saturday with Colm Ó Mongáin show.

Richmond said he was not aware of any other write-downs of that size at a state-owned bank, adding that the Irish Government does not have policy direction over affairs at AIB even though it is a majority shareholder.

Meanwhile, People Before Profit TD Richard Boyd-Barrett described the settlement as "extraordinary".

"I mean just think of the hardship that so many people went through, homes being repossessed, people being chased for every cent when they were being crucified with unemployment and austerity and then it seriously begs the question: Is there one law for the rich and well-gotten as against what everyone else had to endure during that period?" Barrett said.

"And for it to be in a bank that had been bailed out by the people, that was owned by the people, we need to get to the bottom of it."

Comments