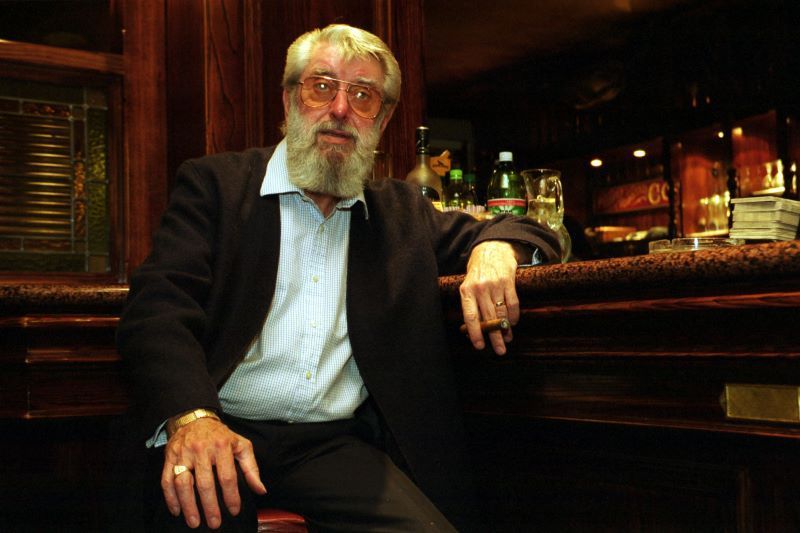

Paul Krugman,Nobel Prize winning economist and New York Times columnist. has laid the failure of the Irish economy in the past two years squarely at the feet of those whose job it was to regulate and oversee banks.

Krugman's Monday columnn is given over to an examination of the two crises in the U.S. and Ireland which he says were similar in impact but very different in how they came about.

In Ireland he says there were no exotic financial instruments such as derivatives which caused such grief over here.

He writes "As a new research paper by the Irish economists Gregory Connor, Thomas Flavin and Brian O’Kelly points out, “Almost all the apparent causal factors of the U.S. crisis are missing in the Irish case,” and vice versa. Yet the shape of Ireland’s crisis was very similar: a huge real estate bubble — prices rose more in Dublin than in Los Angeles or Miami — followed by a severe banking bust that was contained only via an expensive bailout."

But Ireland he points out had "none of the American right’s favorite villains: there was no Community Reinvestment Act, no Fannie Mae or Freddie Mac."

Part of the reason he says is that key players in Ireland had no reason to fear failure as they knew regulators were on their side and they would be bailed out if all went wrong.

"Rogue-bank heads retired with their large fortunes intact.” There was a lot of this in the United States, top executives at failed U.S. financial companies received billions in “performance related” pay before their firms went belly-up.

But Krugman says the key reason why the economy has tanked in Ireland was “regulatory imprudence”: the people charged with keeping banks safe didn’t do their jobs.

"In Ireland, regulators looked the other way in part because the country was trying to attract foreign business, in part because of cronyism: bankers and property developers had close ties to the ruling party."

Krugman says the lesson from the Irish crisis is that "letting bankers do what they want is a recipe for disaster."

"That’s why we need an independent agency protecting financial consumers," he concludes.

Comments