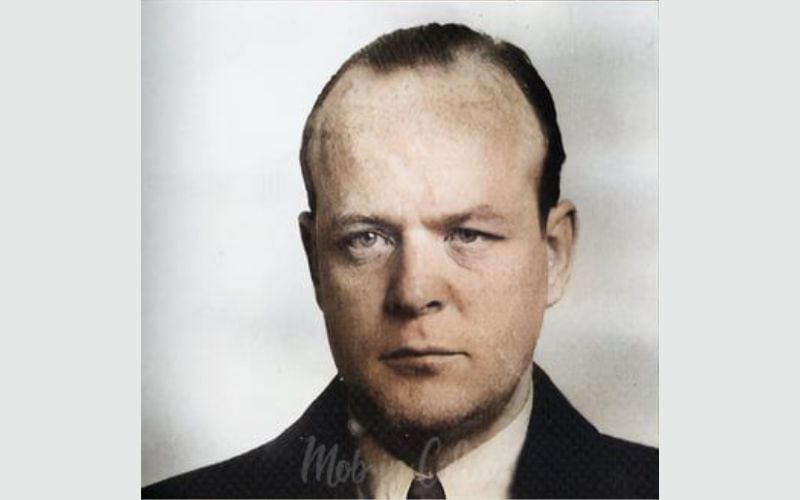

| Sean Gallagher at the press conference following the Prime Time Presidential debate. Picture: Sasko Lazarov/Photocall Ireland |

The ongoing Irish presidential election is just a distraction. An amusing one at times, I admit. But a distraction nonetheless from some extremely serious issues that are crying out for attention here.

One of them came up last week, an issue that is causing sleepless nights to thousands of people here. But it was swiftly drowned in the sea of electioneering nonsense.

We'll come back to that in a minute. But first let's get the distraction out of the way.

There's just a over a week to go in the presidential election now and the papers here are full of it. It's the dirtiest campaign ever, with each day bringing embarrassing new revelations about the candidates.

If it's not Michael D. Higgins smoking dope, or Dana's "family secrets,” it's David Norris doing his son of Dracula impersonation.

Norris has been so freaked by the media that he now has a ferocious toothy grin permanently fixed on his face whenever he appears in public. Between that and his crazed eyes, it's extremely disturbing.

This week we reached a new low, with one paper running a story claiming that one of the candidates had been reported to the police last week for making an unwanted sexual move on someone -- over 20 years ago!

No name was given, and I'm not handing out prizes for guessing right. It just shows the level we've got down to here.

In a different league, because it's serious, is Martin McGuinness, desperately trying to find answers that are acceptable in the south to the kind of questions about his past that no one in the North bothers to ask anymore.

As you know, he was confronted last week by the son of an Irish soldier killed by the IRA after they had kidnapped a supermarket boss in the south in the 1980s. The confrontation with the dead soldier's son was caught on camera and McGuinness’s feeble, slithery attempt to deal with it has done him no favors with voters.

And there is more where that came from, given the violence the IRA was guilty of in the South over the years when they were "fundraising" from the banks, running protection rackets and intimidating witnesses in court cases, among other activities here.

The big surprise has been the emergence of the independent candidate Sean Gallagher, who topped the list in one opinion poll here last weekend, way ahead of Higgins who everyone had thought was a shoe-in.

Gallagher's claim to fame is that he was one of the millionaire investors on the Irish version of the Dragon's Den TV show. Being a well-known face is half the battle, plus he is emphasizing his business experience at a time when the economy is badly in need of a lift. People seem to be impressed by that.

But the reality behind the image is not so impressive. It turns out he's not so rich, since he was very slow in paying back a small state grant he got for one venture (he switched companies to try to avoid it). Another venture to develop a housing scheme has bitten the dust.

So far Gallagher has managed to float above the personal mud that is flying in the campaign. And he has managed to maintain the fiction that he is a non-party candidate.

Technically he is, but that ignores his involvement with Fianna Fail at senior level for years, on the National

Executive and as political secretary to a former minister for health. He now claims to be independent, but he's really Fianna Fail-lite, the soft option for all the Fianna Fail voters out there who don't have a candidate to vote for, and all the Fine Gael voters who have given up on Gay Mitchell and will die with embarrassment if Higgins gets in and starts emoting for Ireland.

So there's really no mystery about Gallagher's "surprising" rise to the top of the opinion polls. There's a huge army of people out there who used to vote Fianna Fail, and Gallagher is "independent" in the right way to appeal to them.

Plus he's not a Fine Gael old hand like Mitchell. He's new, he's well-known from TV, he's a pretty good candidate and a good performer on the campaign trail.

He's also a people person, and I have a story to illustrate that.

My teenagers reminded me a few days ago that the very same Sean Gallagher appeared in their school last year to give a talk (he was invited as a successful businessman, famous then only for being on Dragon's Den).

He made a huge impression on my boys and, believe me, that's not easy.

Here's how he did it. He started by telling the kids that he had impaired vision (which is true) and that those at the back of the classroom were a bit of a blur to him, so he couldn't be sure if they were boys or girls. But he would do his best, he said.

When he finished his inspirational talk about being an entrepreneur, he invited questions and asked the kids to say their name when they were asking one. The discussion became pretty intense, and soon kids were jumping up all around the room to fire questions at him and argue with each other.

In his answers Gallagher frequently referred to what other kids had said, naming them and pointing to exactly where they were in the room as he did so.

"It was amazing Dad,” my son said. "He remembered all the names and where everyone was and what they said, even people at the back of the room. I don't know how he did it. You should vote for him."

I probably won't, even though that is more impressive than anything I've heard about the other candidates in this presidential campaign.

I'll probably vote for Mitchell because the guy has earned it. He has the most political experience, he doesn't talk bull, he's the only one with the balls to tackle McGuinness and he's not trying to pretend the presidency is some kind of executive role. Not that my voting for him is going to matter, given where he is in the polls.

None of it matters anyway, as I said above, because it's all just a silly distraction. Given the real problems we face and the real decisions we have to take, it's in the same territory as rearranging the deck chairs on the Titanic.

One of these real problems is the second wave of the financial crisis that is now hitting home here.

The first wave to hit was at what economists call the macro level and involved getting tens of billions to save the banks and then getting the bailout for even more tens of billions to save the state. It flattened the country, saw unemployment soar and cost us our economic sovereignty.

A lot of people thought that was the end of it. But no, there's a second wave in our financial crisis that is now hitting us at what economists call the micro level. Or the individual level.

Instead of the big time speculators and developers who stung the banks for a billion or more each, this one involves the individual home owner, the individual family. It's the mortgage crisis.

Typically it involves someone who bought a home during the two or three years when the boom was approaching its peak in 2007. That person probably paid somewhere between €250,000 and €500,000 and it's now worth half what they paid.

Given the collapse in the economy, the individual also may have lost his or her job. If it was a couple, one or both of them may unexpectedly be out of work.

So they can't make the payments on the 100% mortgage they took on. If they sell they will only get half what they paid for the property, and even if they give that back they will still owe the other half to the bank they got the loan from.

As I explained before here, unlike in America you can't just throw the keys back at the bank and tell them to keep the house and wipe the loan debt. Here you still owe all of the money.

If it were just a few people here who were in this situation it would not be too difficult to handle. But it's thousands, tens of thousands.

According to the Central Bank, there are now 46,000 households that are three months behind on payments, and of those just over 40,000 are more than six months in arrears. People who work in the personal finance sector here say that the real figure for those in serious difficulty is more than 10% of all mortgage holders.

The problem is that there is no way out for these people. There is no IMF bailout for them.

The IMF bailout money the banks got was calculated to include provision for a reasonable level of individual mortgage default. But instead of using it to let individuals default on their mortgages or write down some of the debt, the banks are holding on to it for their reserves and demanding full payment from the householders.

Well, that's what banks do. They screw everyone.

The problem for the government is that a solution has to be found for this mess, otherwise there's going to an awful lot of families on the streets and an awful lot of suicides. It's that serious.

So the government set up a think tank of experts led by one Declan Keane, a top level KPMG accountant on secondment to the Department of Finance. And just over a week ago the Keane Report was published.

What it had to say was buried under stupid election "news" about our presidential candidates, which why I'm saying this election is a silly distraction from things that really matter to tens of thousands of people.

The big news in the Kenny Report is that there is no easy solution, which is no surprise to me. What it comes up with is a list of options for the government that can be taken to alleviate the situation. But most of them are unsatisfactory from the individual's point of view.

The big failing in this report is that most of what Kenny is proposing leaves the banks virtually untouched. But then that's hardly a surprise since Kenny comes from KPMG, one of the three or four big accountancy firms that dominate the market here.

The members of his think tank were all insiders like him, bankers, accountants, politicians, senior civil servants. It's the same old inner circle of "experts" who sat on their hands while the banks dished out huge loans on 100% mortgages to people who could not afford them if anything went wrong.

These are the same "experts" who watched the property boom spiral out of control and talked about a soft landing.

So instead of forcing the banks to take a big hit and write off large chunks of these mortgages to reflect negative equity and/or inability to pay, the banks have got off scot free. The report rules out blanket debt forgiveness as too costly for the banks to bear.

The big idea in the report is to get local councils or the state (in other words the taxpayer) to pay off the bank loans, take ownership of the homes, and then rent them to the householders. So the homeowners get to stay in their homes ... but they don't own them anymore.

No embarrassment, just a nice, neat solution. And the banks get ALL their money back.

The report estimates that up to 10,000 people will take this option, lose the ownership of their homes and pay rent instead to keep the same roof over their heads. The report says that mass debt forgiveness for those in negative equity is too expensive and would cost the banks around €14 billion which they cannot afford.

The report says that the vast majority of mortgage holders can and must continue to repay their debts, perhaps at a slightly lower rate over an extended period.

This means that many of these householders will get to the end of their working lives after making huge mortgage payments every month for years and they still won't own their homes.

There are other options in the report, but they are all variations of these two basic proposals -- lose ownership or extend the loan term to forever.

All of this is wrapped up in complex financial jargon about mortgage to rent schemes, split mortgages, parked loan sections, trade down schemes and so on. But the bottom line is that the banks get back their money in full. And the householders and the taxpayers are screwed once again. The government now has to decide what to do. So we will wait to see what the decision is before exploring this any further.

In the meantime, we can all amuse ourselves with the election for a president who won't have any power to change a thing.

Comments